Understanding Coinbase and Cryptocurrency Exchanges

An independent educational guide for beginners

Educational Disclaimer: This website is independent and not affiliated with Coinbase. Content is for educational purposes only and does not constitute financial advice.

What Are Cryptocurrency Exchanges?

Cryptocurrency exchanges are digital platforms that allow users to buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, and other digital assets. They serve as intermediaries between buyers and sellers, providing a secure environment for cryptocurrency transactions.

These platforms have become essential infrastructure in the cryptocurrency ecosystem, offering various services from simple buying and selling to advanced trading features, wallet storage, and educational resources.

Key Functions of Crypto Exchanges

- Facilitate buying and selling of cryptocurrencies

- Provide secure storage solutions

- Offer trading tools and market data

- Enable conversion between cryptocurrencies and fiat currencies

What Is Coinbase?

A factual overview of one of the most well-known cryptocurrency exchange platforms

Coinbase is a publicly-traded cryptocurrency exchange platform founded in 2012 and headquartered in San Francisco, California. It operates as a centralized exchange, meaning it acts as an intermediary between users and the cryptocurrency markets.

The platform is designed to make cryptocurrency accessible to mainstream users, offering a user-friendly interface that simplifies the process of buying, selling, and storing digital assets. Coinbase serves millions of users across multiple countries and supports dozens of different cryptocurrencies.

Key Characteristics

Note: This information is provided for educational purposes only. Always conduct your own research before using any cryptocurrency platform.

How Coinbase Works

Understanding the basic process of using a cryptocurrency exchange platform for educational purposes.

Getting Started Process

Account Registration

Users typically create an account by providing personal information and completing identity verification processes required by financial regulations.

Account Verification

Identity verification usually involves submitting government-issued ID and completing Know Your Customer (KYC) requirements.

Funding Your Account

Users can link bank accounts, debit cards, or other payment methods to add funds to their exchange account.

Trading Process

Browse Available Cryptocurrencies

Users can view supported cryptocurrencies, their current prices, and market information on the platform.

Place Buy or Sell Orders

Users can purchase cryptocurrencies using their account balance or sell existing holdings back to fiat currency.

Store or Transfer

Purchased cryptocurrencies can be stored in the exchange wallet or transferred to external wallets for additional security.

Key Features of Coinbase

Educational overview of the main features and capabilities that users should understand about this cryptocurrency exchange platform.

User-Friendly Interface

Coinbase is known for its intuitive design that makes it accessible for beginners to navigate cryptocurrency trading.

- Simple buy/sell interface

- Mobile app availability

- Educational resources

Cryptocurrency Variety

The platform supports a wide range of cryptocurrencies, from major coins to newer altcoins.

- Major cryptocurrencies

- Regular addition of new assets

- Detailed asset information

Multiple Service Tiers

Coinbase offers different platforms for various user needs, from basic to advanced trading.

- Basic consumer platform

- Advanced trading features

- Institutional services

Additional Platform Features

Wallet Services

Built-in wallet for storing cryptocurrencies

Regulatory Compliance

Licensed and regulated in multiple jurisdictions

Instant Transactions

Quick processing for supported payment methods

Customer Support

Multiple support channels and help resources

Security and Safety Practices

Understanding general security measures and best practices when using cryptocurrency exchanges. This information is educational and does not constitute security guarantees.

Exchange Security Measures

Cryptocurrency exchanges typically implement various security measures to protect user accounts and funds. Understanding these measures can help users make informed decisions.

Two-Factor Authentication (2FA)

Additional security layer requiring a second form of verification

Cold Storage

Majority of funds stored offline in secure, air-gapped systems

Encryption

Data encryption for sensitive information and communications

Regular Security Audits

Ongoing security assessments and vulnerability testing

User Security Best Practices

Strong Passwords

Use unique, complex passwords and consider password managers

Enable 2FA

Always activate two-factor authentication when available

Monitor Activity

Regularly review account activity and transaction history

Beware of Phishing

Always verify URLs and be cautious of suspicious emails

Secure Networks

Avoid public Wi-Fi for sensitive transactions

Consider Hardware Wallets

For long-term storage, consider offline wallet solutions

Important Security Disclaimer

This information is provided for educational purposes only. No security measures are 100% foolproof, and cryptocurrency investments carry inherent risks. Users should conduct their own research and consider their risk tolerance. This website is not affiliated with Coinbase and does not provide financial or security advice. Always verify information independently and consult with qualified professionals when making financial decisions.

Understanding Exchange Fees

Learn about the different types of fees commonly found on cryptocurrency exchanges and how they work.

Trading Fees

Most exchanges charge a percentage-based fee for each buy or sell transaction. These fees typically vary based on trading volume and account type.

Spread Costs

The difference between buy and sell prices (spread) represents an indirect cost that affects the total amount you pay or receive.

Network Fees

When transferring cryptocurrency to external wallets, blockchain network fees apply. These fees fluctuate based on network congestion.

Additional Services

Some platforms may charge for premium features, instant transfers, or specialized trading tools.

Important Considerations

- •Fee structures vary significantly between different exchanges

- •Always review current fee schedules before making transactions

- •Consider total costs including spreads and network fees

- •Fee structures may change over time

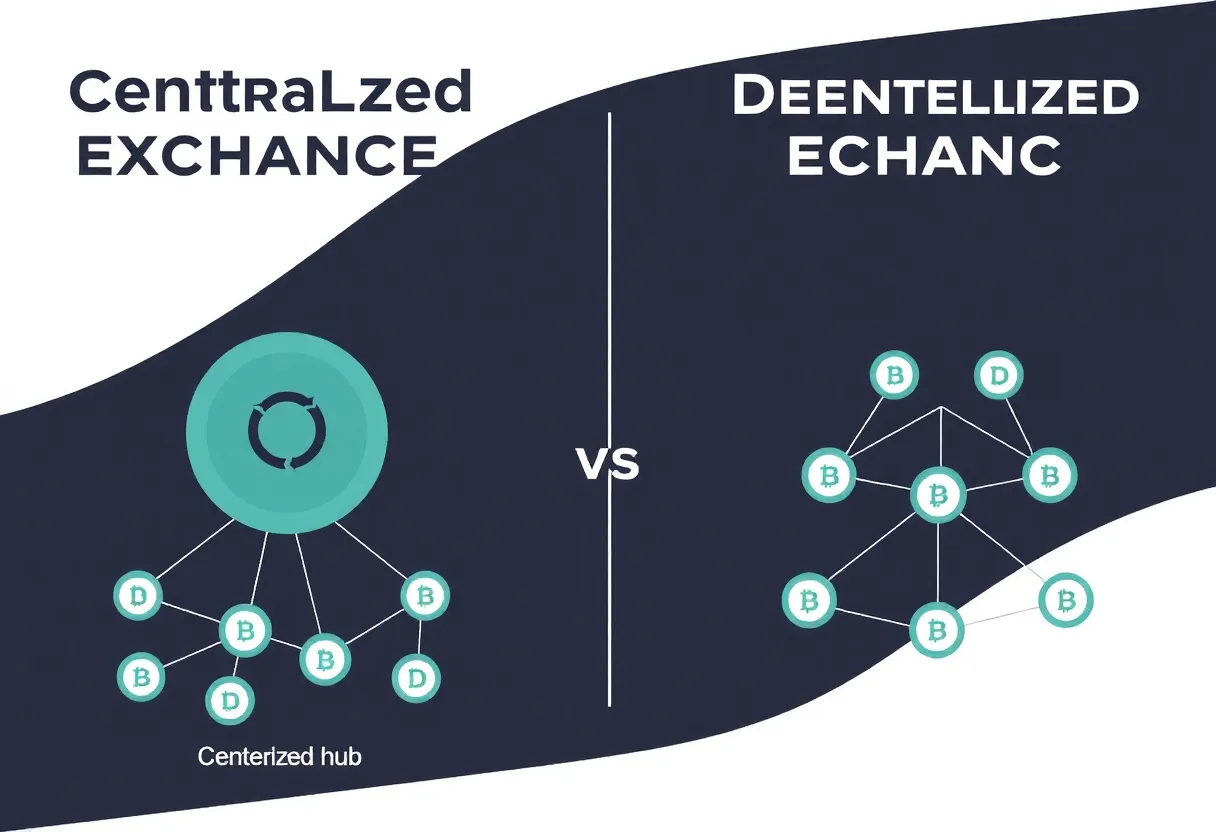

Centralized vs Decentralized Exchanges

Understanding the trade-offs between different types of cryptocurrency exchanges to make informed decisions.

Centralized Exchange Advantages

- ✓User-friendly interfaces for beginners

- ✓Customer support services

- ✓Higher liquidity for major cryptocurrencies

- ✓Regulatory compliance and oversight

- ✓Fiat currency integration

- ✓Advanced trading features

Centralized Exchange Limitations

- !Users don't control private keys

- !Potential for service outages

- !KYC/AML requirements

- !Geographic restrictions may apply

- !Centralized point of failure

- !Withdrawal limits and restrictions

Decentralized Exchange Benefits

- ✓Users maintain control of funds

- ✓No KYC requirements typically

- ✓Censorship resistance

- ✓Global accessibility

- ✓Transparent operations

Decentralized Exchange Challenges

- !Steeper learning curve

- !Lower liquidity for some pairs

- !Higher network fees during congestion

- !Limited fiat integration

- !No customer support

Choosing the Right Exchange Type

Centralized exchanges may be suitable for:

- • Beginners new to cryptocurrency

- • Users who prioritize convenience

- • Those needing fiat currency integration

- • Traders requiring high liquidity

Decentralized exchanges may appeal to:

- • Users prioritizing self-custody

- • Those seeking privacy

- • Advanced users comfortable with wallets

- • Users in restricted jurisdictions

Frequently Asked Questions

Common questions about cryptocurrency exchanges and how they work.

What is a cryptocurrency exchange?

A cryptocurrency exchange is a digital platform that allows users to buy, sell, and trade cryptocurrencies. These platforms facilitate the conversion between different digital assets and often between cryptocurrencies and traditional fiat currencies.

How do I choose a cryptocurrency exchange?

Consider factors such as security features, supported cryptocurrencies, fee structures, user interface, regulatory compliance, customer support, and geographic availability. Research and compare multiple options before making a decision.

What is KYC and why do exchanges require it?

KYC (Know Your Customer) is a verification process where exchanges collect personal information to comply with anti-money laundering regulations. This typically involves providing identification documents and proof of address.

Should I keep my cryptocurrency on an exchange?

For long-term storage, many experts recommend transferring cryptocurrency to a personal wallet where you control the private keys. Exchanges are convenient for trading but keeping large amounts on exchanges long-term carries additional risks.

What are the main types of cryptocurrency exchanges?

The main types include centralized exchanges (CEX) which are operated by companies, decentralized exchanges (DEX) which run on blockchain protocols, and peer-to-peer platforms that connect buyers and sellers directly.

How do exchange fees work?

Exchanges typically charge trading fees as a percentage of transaction value, plus potential network fees for blockchain transactions. Fee structures vary between platforms and may depend on trading volume, account type, and payment method.

What security measures should I look for in an exchange?

Look for features like two-factor authentication, cold storage for funds, insurance coverage, regular security audits, and a track record of protecting user assets. No exchange is completely risk-free, so research their security practices.

Can I use multiple exchanges?

Yes, many users utilize multiple exchanges to access different cryptocurrencies, take advantage of varying fee structures, or reduce concentration risk. However, this requires managing multiple accounts and security considerations.

Educational Disclaimer

This information is provided for educational purposes only and should not be considered financial advice. Cryptocurrency investments carry risks, and you should conduct your own research and consider consulting with financial professionals before making investment decisions.

Important Disclaimer

Please read this disclaimer carefully before using this website.

Independent Educational Resource

trezaerui.store is an independent educational website that provides information about cryptocurrency exchanges and related topics. We are not affiliated, associated, authorized, endorsed by, or in any way officially connected with Coinbase, Coinbase Global Inc., or any of its subsidiaries or affiliates.

Educational Purpose Only

All content on this website is provided for educational and informational purposes only. The information presented here should not be construed as:

- Financial, investment, or trading advice

- Professional recommendations or endorsements

- Guarantees of performance or results

- Official statements from any cryptocurrency exchange

No Financial Advice

We do not provide financial advice, investment recommendations, or trading strategies. Cryptocurrency investments carry significant risks, including the potential for total loss of capital. Always consult with qualified financial professionals before making any investment decisions.

Accuracy and Currency of Information

While we strive to provide accurate and up-to-date information, cryptocurrency markets and exchange policies change rapidly. We cannot guarantee the accuracy, completeness, or timeliness of any information presented. Users should verify all information independently through official sources.

No Liability

trezaerui.store and its operators shall not be liable for any direct, indirect, incidental, consequential, or punitive damages arising from your use of this website or reliance on any information provided herein.

External Links

This website may contain links to external websites for reference purposes only. We do not endorse or take responsibility for the content, privacy policies, or practices of any third-party websites.

Last updated: December 2024. This disclaimer may be updated periodically without notice.